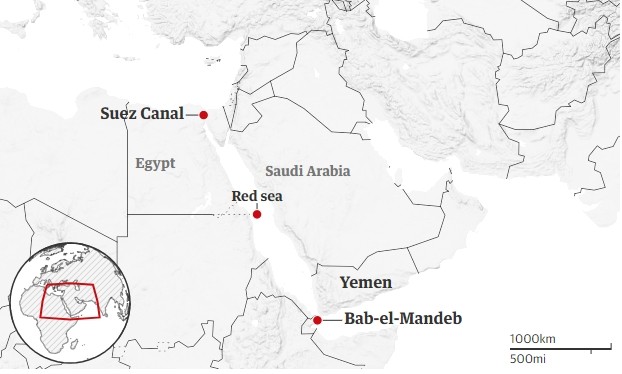

Navigating Risk: Red Sea Shipping Crisis

Regretfully, a lot of commercial container ships, including Maersk, Mediterranean Shipping Company, CMA CGM, and Hapag Lloyd, are currently stopping their trips over the Red Sea due to the worsening situation there. There are rumors that other ship owners, like British Petroleum, are planning to follow suit, which might put an end to transnational travel for the whole sector.

The Houthi rebels in Yemen successfully took control of the Galaxy Leader last month, and there have been other recent strikes as well.

It is anticipated that the ships, which are currently trapped on either side of the Red Sea, will hold off on resuming operations until there is more security in the area. Additionally, carriers will think about sending ships from Europe via South Africa’s Cape of Good Hope.

Since the Suez Canal is a vital strategic route for ships traveling to and from Europe, we anticipate that most associated maritime services will be provided by:

1. Longer transit times.

2. A decrease in available space and equipment.

3. A rise in the price of containers SPOT.

4. Vessel omissions and delays to container vessel departures from Europe.

5. Implementation or augmentation of War Risk Surcharges (WRS).

To reduce the danger resulting from incidents like these, we advise our clients to make sure their marine insurance policies are current and, at the very least.

WAAVV will keep our clients informed about this situation as it moves forward.

Note: Since many of these services are connected to international trips that start in Asia, we do not anticipate any more problems with the inbound RoRo services from Europe to Australia as they depart via Africa in the near future. However, if global trade is disrupted in the new year, the situation may get worse.